The limits of test and learn

How many people have moved to UC through managed migration?

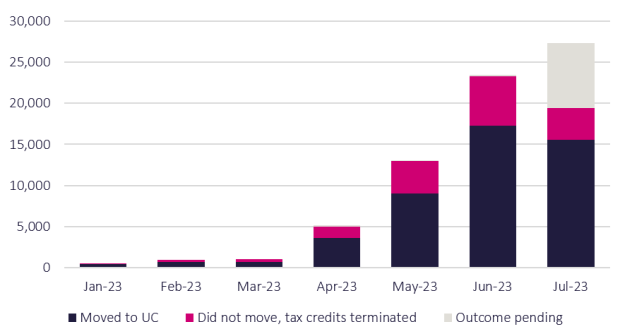

Today the DWP published the latest data on the outcomes of tax credit claimants who have been sent their ‘migration notice’. This is a letter informing people that they have three months to make a claim for universal credit (UC), at which point their tax credit payments will be terminated. The data reveals that 16,000 people sent a migration notice did not make the transition to UC and had their legacy benefits terminated. This equates to 27 per cent of those who have been sent a migration notice and reached their deadline (based on those sent a migration notice in the first half of 2023).

Number of claimants sent a migration notice in the first half of 2023 by outcome

How much are people losing from not moving to UC?

What the latest statistics don’t tell us is how much people who aren’t moving to UC are losing in tax credits. A freedom of information (FOI) request from Z2K reveals that these claimants were receiving on average £300 a month through tax credits (this data refers to 770 claimants who were sent a migration notice between November 2022 and March 2023 and did not claim UC before their legacy benefit claims were closed – we will reissue the FOI to get the latest data).

Why aren’t some people claiming?

The DWP’s August report outlined three themes showing why a ‘consistent, if relatively small, proportion of tax credit claimants [are] not making a claim to Universal Credit’, based on the ‘significant amount of research and analysis’ done on this issue. The themes were:

- Some claimants made a conscious decision not to claim. Where the amount they would receive was particularly small, they did not see it as worthwhile to claim.

- Some claimants believed they were not eligible for UC, as their circumstances had recently changed, and their tax credits had already stopped.

- Some claimants felt a stigma attached to claiming UC.

We found it hard to align these reasons with the average tax credit award lost being £300 – is the stigma of UC so great, is the admin that significant that claimants would forgo £300 a month, as well as the cost of living payments? So, we sent another FOI to understand the details behind the research which produced these explanations. In response, the DWP told us:

- They did not conduct any research with the 770 people who did not make a UC claim and had their tax credit claims terminated.

- The themes identified on why people did not claim UC were based on in-depth discussions with ‘a small sample of claimants’ that ‘were not specifically coded or broken down numerically.’

- They have not conducted analysis to estimate how many people may not have moved to UC because their circumstances have improved, and they no longer need tax credits, or because their tax credit claims were fraudulent.

Simply put, the DWP doesn’t know what proportion of claimants are making a truly informed decision not to claim.

Have we reached the edge of the DWP’s test and learn approach?

The DWP has described its approach to the roll out of UC, including managed migration, as a ‘test and learn’ approach, whereby ongoing testing is carried out to identify problems as they arise so they can be fixed quickly and before larger numbers are affected. Despite providing no explanation for why so many people with a strong financial incentive to move to UC are not doing so, the DWP continues to rapidly increase the number of migration notices it is sending to claimants each month. It has also refused to publish the ‘readiness criteria’ it uses to determine if it’s ‘safe and secure’ to scale managed migration further.

While the DWP says it has yet to have anyone call up the tax credit helpline to ask why their benefits have been terminated, this does not necessarily indicate financial resilience or an informed decision not to claim. CPAG has interviewed tax credit claimants who have been sent a migration notice, and many were surprised to learn that they did qualify for UC and were fearful of the conditionality and uncertainty of a UC claim.

What does the future hold?

Our primary concern is that claimants will not make a claim for UC, have their legacy benefits terminated, and experience considerable financial hardship as a result. The consequences of not claiming UC will be greater for some than for others. While those in the worst financial situations are likely to qualify for UC as a new claimant, they could be worse off overall once they do claim. Any disruption in their benefit payments, followed by the five-week wait for UC, and an ongoing award which may be of lower value than their legacy benefits, could cause serious harm such as accruing unmanageable debt, threats of eviction, and in some cases destitution.

This was always going to be the risk with managed migration, and the DWP assured us that through its test and learn approach such risks would be identified and mitigated before they affected people at scale. But, as the DWP has begun to scale managed migration, it appears to have accepted that a large minority of tax credits claimants will see their incomes drop by £300 a month despite not knowing if this was an informed decision.

Next year the DWP plans to scale managed migration to people who also claim DWP legacy benefits for whom benefits will be their primary or even only source of income (this includes disabled claimants of employment and support allowance who also receive tax credits). It’s likely that the proportion of these claimants who move to UC will be higher out of financial necessity on the part of the claimant. But what will the DWP do to support those who do not claim before the deadline? Will it test and learn to ensure that all those who are eligible for UC have the support and information they need to make the move? What we have seen of managed migration so far does not fill us with hope.

CPAG’s research on managed migration has been funded by the abrdn Financial Fairness Trust but the views expressed are those of the authors and not necessarily the Trust. abrdn Financial Fairness Trust funds research, policy work and campaigning activities to tackle financial problems and improve living standards for people on low-to-middle incomes in the UK. It is an independent charitable trust registered in Scotland (SC040877).