On this page

- Overview

- Migration to universal credit

- Universal credit claims and administration

- Who can claim universal credit

- Universal credit and students

- Universal credit and looking for work

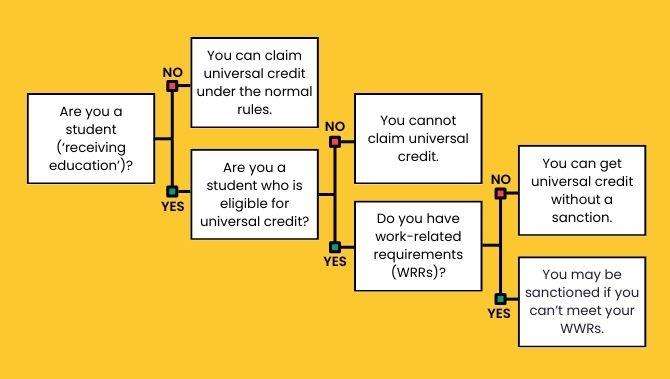

- Flowchart: students and universal credit

- Universal credit and student income

- Further information

Overview

Students cannot usually claim universal credit, unless they have children, live with a non-student partner, are disabled, or are young students in non-advanced education with no parental support.

This covers the main universal credit eligibility rules as they apply to students, but there are other general rules to satisfy, so seek further information and advice. Students from abroad must satisfy additional rules - for more details see factsheets on benefits for migrants.

Migration to universal credit

Many people are already on universal credit (UC), which has gradually replaced most means-tested benefits. A few people are still on income-related employment and support allowance (ESA) and housing benefit (HB). Sometimes a change in circumstances means it is best to claim UC, and, if you do, your income-related ESA and possibly your HB (see next paragraph) will end (usually two weeks after you claim UC). This is referred to as ‘natural migration’. If you are still on these benefits, you should get independent advice before claiming UC, to check it is the best option for you.

If you get a ‘migration notice’, you are expected to claim UC within three months. This is often referred to as ‘managed migration’. Special rules allow students who manage migrate to UC to get UC even if they are not a student who can normally get UC. Whether you claim UC or not, your income-related ESA and possibly your HB (see next paragraph) will stop after the three months (usually two weeks after you claim UC). You can find more information about this on gov.uk.

Usually, no new claims can be made for these benefits – you have to claim UC instead. There is an exception if you live in ‘specified’ supported or temporary (eg, homeless) accommodation. In this case you claim HB for help with rent (sometimes as well as UC for your living costs), and your rent will continue to be paid by HB - ie, you won't migrate to UC from HB if you live in this kind of accommodation.

Universal credit claims and administration

You start your claim for UC online at gov.uk. If this is not possible for you, you can get assistance from the UC helpline on 0800 328 5644 (freephone).

Administration of UC is by the Department for Work and Pensions (DWP), and payments are made monthly in arrears. It may be five weeks or more from claiming UC until your first payment is received. If you need money sooner you can ask for a short-term advance, which is repayable from your UC once payments start.

You do not usually need to report changes in earnings as an employed earner, as HM Revenue and Customs provide this information directly to the DWP in most cases. You do need to tell them about other income, such as student loans and grants, and to tell them you have started studying.

Who can claim universal credit

Once you claim UC you stay on it, if still eligible and with a low enough income, even if your circumstances change, eg, if you have a baby, or become disabled. However, if you no longer meet the basic entitlement rules, eg, because you start a full-time course and are not a student who can get UC, or if your income is too high, your UC will stop.

You can get UC if you have a low enough income, whether you are in or out of work. You can claim provided you meet basic conditions about age, education and residence in the UK, and you do not have capital of £16,000 or more. So, for example, parents, people with a disability and unemployed people can claim UC. It can include amounts for adults, children, disability, caring responsibilities, rent and childcare, depending on your circumstances.

UC is for people aged 18 or over, although some 16/17-year-olds can claim, for example, if you are estranged from your parents, are a parent yourself, are sick or disabled, or are caring for someone with a disability.

You may not be eligible for UC if you are not a UK national, although this is complex, so seek advice.

Universal credit and other benefits

Although working age means-tested benefits and tax credits have mostly ceased to exist, most other benefits continue, either as before or with some changes. For example, child benefit continues to exist as a separate benefit for people with children, and adult disability payment continues to exist as a separate benefit for people with disabilities.

A ‘new-style’ contributory ESA and JSA exist, along with UC. You can claim these if you have paid enough NI contributions. If you are a full-time student and meet the qualifying conditions, you are eligible for new-style ESA. However, if you are a full-time student you are only eligible for new-style JSA if you have taken time out from your course because of illness or caring responsibilities, you have now recovered or your caring responsibilities have ended, and you are waiting to rejoin your course. For more information about other benefits you may be able to claim while you are studying, see CPAG’s Benefits for Students in Scotland Handbook.

Universal credit and students

You may be advised to claim UC if you have a change of circumstances. You should always seek advice about whether this is the best course of action, for example from a CAB or other welfare rights adviser.

The following sets out the rules for you if you already get UC and you start a course, or if you are already a student and you claim UC. Usually, if you become a student, you will not be able to get UC, but there are exceptions.

Who is a student for UC?

You count as a student (the law says you are ‘receiving education’) for UC if you are:

- in full-time (over 12 hours per week) non-advanced education which you started (or were accepted or enrolled on) when you were under 19, and you have not yet reached 31 August after your 19th birthday, or

- on a full-time course of advanced education, or

- on another full-time course for which a loan, grant or bursary is provided for your maintenance, or

- (if none of the above apply) on a course which is not compatible with your work-related requirements.

If you count as a student, you cannot get UC unless you are in one of the groups of students who can claim (below), or if you have claimed UC after getting a migration notice (see above). If you do not count as a student under any of the definitions above, you can claim UC under the normal rules. This could apply, for example, if you are 20 or over on a non-advanced course with no student income, and the course is compatible with your work-related requirements, eg because you are disabled and have no or limited work-related requirements.

Example

Zoe is on a full-time advanced course and gets a student loan. She is ‘receiving education’, and is not eligible for UC as she is not in any of the groups of students that can claim UC.

Example

Peter is on a full-time non-advanced course, and is 21. He gets UC and has limited capability for work-related activity. This means he has no work-related requirements. He gets no student funding. He therefore does not count as ‘receiving education’ and can remain on UC.

Example

Juan is 24 and on a full-time non-advanced course, with a bursary for maintenance. He therefore counts as ‘receiving education’. He is not eligible for UC as he is not in any of the groups of students that can claim UC. He relies on his bursary, together with discretionary funding from the college, and earnings from part-time work, during his course.

Which students can claim UC

If you do not count as a student (‘receiving education’), for example because you are 20 or over on a non-advanced course with no student income, and the course is compatible with your work-related requirements, see above, you can claim UC.

If you are studying and receive a migration notice, see migration to universal credit.

Otherwise, you are only eligible for UC if you are a student (‘receiving education’) if:

- you are a parent (‘responsible for a child’). You must have a child that is under 16, or 16-19 in full-time non-advanced education. Where separated parents share the care of a child, only one can be responsible (the one with ‘main’ responsibility);

- you are ill/disabled. You must have been assessed by the DWP as having limited capability for work before you start your course, and also get adult disability payment (ADP), personal independence payment (PIP), disability living allowance (DLA) or child disability payment (CDP). If you have not yet been assessed as having limited capability for work, you cannot claim UC. Instead, you can claim ‘new-style’ (contributory) ESA on a credits-only basis to have your limited capability for work assessed, and then claim UC when your course has ended, and before you start any subsequent course;

- you are under 21 (or are 21 but were under that age when you started your course) on a full-time non-advanced course and are ‘without parental support’ (see below), eg, you are estranged from your parents or living away from them in other specified circumstances;

- you are a single foster parent (this includes some single kinship carers), or you are in a couple, both of you are students, and one of you is a foster parent;

- you are over pension age (this is age 66);

- you have taken time out of your course because of illness/disability or caring responsibilities and have now recovered or your caring responsibilities have ended, and you are not eligible for a grant or loan; or

- you have a partner who is not a student, or who is a student and one or both of you fit into one of the groups above.

Definitions

‘Without parental support’ means you:

- have no parent, or

- are living away from parents because you are estranged from them, or because there is a serious risk to your physical or mental health, or you would suffer significant harm if you lived with them; or

- are living away from parents who cannot support you financially because they are ill or disabled, in prison, or not allowed to enter Britain.

‘Parent’ includes someone acting in place of a parent.

Note: if you are aged 16 or 17 and a student you can only claim UC if you fit into one of the first three bullet points above (ie, you are responsible for a child; ill/disabled; or ‘without parental support’ and in non-advanced education). 16/17-year-old care leavers who are students can only claim if they are responsible for a child, or are ill/disabled, and cannot get help with rent.

Example

Becky is 24 and on a full-time advanced course and is a lone parent with a five-year-old child. She is eligible for UC.

Example

Sam is 20 and is ill and cannot work, but does not get ADP, DLA or PIP. He is on a full-time advanced course. He is not eligible for UC.

Example

Jasper is 16 and on a full-time non-advanced course. He is estranged from his parents and does not live with them. He is eligible for UC.

Example

Fiona and Rory live together as a couple. Rory is on a full-time advanced course. Fiona is unemployed. They can get UC.

Universal credit and looking for work

If you claim universal credit (UC), what you have to do in terms of looking for work can range from having no work-related requirements, to having to look for full-time work.

If you are a student, there are no work-related requirements if you are:

- under 21 (or 21 and turned 21 on your course) in full-time non-advanced education and without parental support; or

- eligible for UC under the usual student exceptions - eg, a parent, and you are in receipt of student income which is taken into account for UC (ie, a student loan or a grant for maintenance). Note: this does not apply if you are eligible because you have taken time out of your course due to illness/disability or caring responsibilities, and have now recovered or your caring responsibilities have ended. It also does not apply over the summer vacation, when student income is generally ignored.

If you do not fit into one of the two bullet points above, you may nonetheless have no work-related requirements under the general rules, for example if you are responsible for a child under one, or you have limited capability for work-related activity.

If you do not fit into any of these groups you may be subject to all work-related requirements, and would therefore have to be available for and actively seeking work.

You may be sanctioned if you are subject to work-related requirements and are not meeting them. A sanction would mean a reduction in UC equal to the amount for an adult.

Example

Stella is 23 and on a full-time non-advanced course. She has a five-year-old child. She does not get a loan or bursary. She is subject to all work-related requirements.

Example

Paula is 23 and on a full-time non-advanced course. She has a five-year-old child. She gets a further education maintenance bursary. She has no work-related requirements.

Example

Laura is 23, on a full-time advanced course and gets a student loan. She has a five-year-old child. She has no work-related requirements.

This chart is to help you check whether a student can get universal credit. For the detailed rules see universal credit and students and universal credit and looking for work.

Alternative text for universal credit and students flowchart

This is an accessible version of the flowchart for use by screenreaders.

Are you a student (‘receiving education')?

If no, you can claim UC under the normal rules.

If yes, are you a student who is eligible for UC?

If no, you cannot claim UC.

If yes, do you have work-related requirements (WRRs)?

If no, you can get UC without a sanction.

If yes, you may be sanctioned if you can’t meet your WRRs.

Universal credit and student income

If you have student income it will usually count as income for universal credit (UC). Most other income you have counts as income for UC as well. Student income includes student loans and grants paid to you for your course. UC takes almost all of student income into account.

One-off payments from discretionary funds count as capital rather than income. As such, if household capital/savings is less than £6,000 it does not affect UC at all, if it is between £6,000 and £16,000 UC is reduced, and if it is above £16,000 no UC can be awarded.

The special support loan, introduced from the academic year 2024/25, does not count as income for UC, as it is specifically for travel, childcare and study costs.

Student loans for maintenance

If you are eligible for a student loan for maintenance it counts as income for UC. The maximum loan you could be entitled to by taking ‘reasonable steps’ is taken into account, even if this is reduced because of household income. A dependent’s grant or lone parent’s grant paid as well as your loan counts as income, but other grants are disregarded (as long as they are not to support your partner or child/ren, or to pay rent covered by UC).

Grants

If you do not get a loan for maintenance, but you receive grant income (eg, a nursing bursary, a care-experienced bursary, or an FE bursary maintenance allowance), the grant income is taken into account for UC (subject to the disregards set out below). If you do get a loan for maintenance, see the section above for what grant income is taken into account.

Education maintenance allowance (EMA) payments are disregarded.

Grant income is disregarded if you do not get a loan and it is paid for any of the following:

- tuition fees or exams

- in respect of your disability

- extra costs due to residential study away from your usual place of study during term time

- the costs of your normal home (where you live somewhere else during your course) unless those costs are met by your UC

- the maintenance of someone who is not included in your UC claim, or

- books, equipment, course travel costs or childcare costs.

Calculating student income for universal credit

UC is paid monthly, for an ‘assessment period’ (a period of one month following your date of claim, and each subsequent month). Student income counts as income from the assessment period in which the course/course year begins, and for every assessment period during the course/course year. It is ignored in the assessment period in which the last week of the course or the start of the long vacation falls, and in any assessment periods that fall completely within the long vacation.

£110 of student income is disregarded in each assessment period that is affected by such income.

Example: universal credit and student loan

Susan is 23, has a three-year-old child and lives in a 2-bed private rented property in Edinburgh. She gets UC of £1,409.79 per month (£316.98 standard allowance + £292.81 child element + £800 for rent).

She starts a two-year full-time HND course on 8 September 2025. Susan’s income for UC is a student loan of £8,000 and a lone parent’s grant of £1,305 (she also gets a £2,400 special support loan and an independent students’ bursary of £1,000, but these don’t count as income for UC).

Year one of her course runs from 8 September 2025 to 22 May 2026. Her UC assessment periods run from the tenth of the month to the ninth of the following month. Her loan counts as income over nine assessment periods in the first year of her course (from 10/8/25 to 9/5/26).

Student income for UC is student loan of £8,000 and lone parent’s grant of £1,305 (total £9,305).

£9,305 / 9 = £1,033.89.

£1,033.89 - £110 = £923.89.

Susan’s UC will be reduced by student income of £923.89 per month from 10 August 2025 to 9 May 2026, so she will get UC of £485.90 per month from 10 August 2025 to 9 May 2026. From the UC assessment period beginning 10 May 2026 she will get her full UC ie, during the summer vacation between the first and second years of her course (but she may also have work-related requirements). Her UC will reduce again in the assessment period in which the second year of her course begins.

Further information

- CPAG in Scotland advice line for frontline advisers and support workers

- CPAG in Scotland's Benefits for Students work, with information on other resources, including training courses on students and benefits

- free online Benefits for Students in Scotland Handbook

- More information about benefits for students on our website

- CPAG's Welfare Benefits Handbook (subscribers only)

- a free students and benefits elearning course

- Follow us on Twitter @CPAGScotland

- more information about the student funding available in Scotland (loans, grants etc) from the Scottish government

- more information from the Students Awards Agency for Scotland

- You can also get advice from student services or advice staff in colleges and universities.